Budget 2022 – Synopsis

The budget proposals for 2022 are based on the government’s sustainable development initiatives to build a green economy and is an extension of the “Vistas of Prosperity and Splendor” policy framework.

The budget proposals have given prominence to the agriculture sector, infrastructure development and renewable energy in terms of fund allocation. One-time taxes and a change to the existing VAT scheme have been introduced with the intention of increasing government revenue.

The proposals have also targeted Sri Lanka to move towards a trading economy as well as supporting small, medium and large-scale entrepreneurs by availing them of facilities that allow them to prosper and thereby contribute towards economic development. Keeping in line with these objectives the government has proposed administrative provisions for developing simplified processes for business registration and efficient tax administration and have proposed to amend the prevailing Value Added Tax act and other relevant legislation in order to rectify inconsistencies

However, no concrete directives are proposed to restructure State-Owned Entities, which are needed for strict fiscal consolidation. As much as 77% of total government expenditure is assigned for recurrent expenditure and a significant one third of this recurrent expenditure is allocated

for salaries and wages, including such expenditure for provincial councils. This suggests that despite the current fiscal dificulties, the government intends spending heavily keeping future elections in mind.

The 2022 Budget has produced more questions than answers but

has created optimism about real estate as an asset class

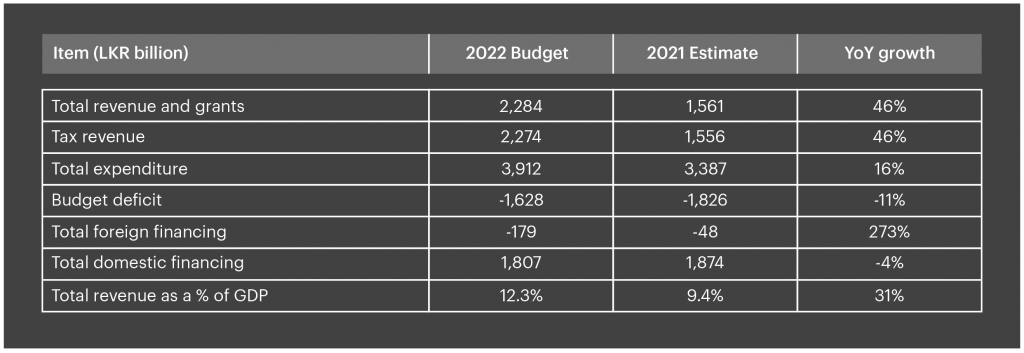

Revenue and Expenditure Summary

Total revenue and grants are forecasted to increase by 46% with the three new tax provisions coming into effect. Additionally, it is expected the treasury would collect LKR 25billion from license fees and other tax revenue. Expenditure would increase by 16% due to the increase in salaries and wages and other public investments. The budget deficit is expected to decline by 11%.

Key highlights

Key Tax Proposals

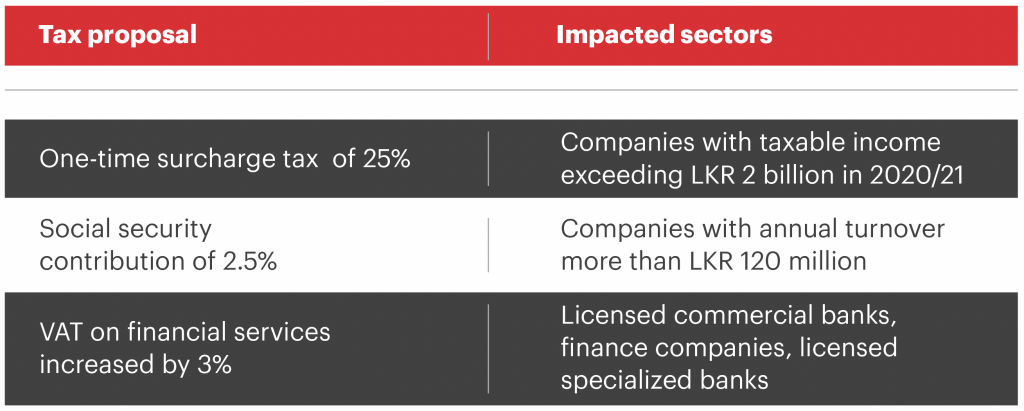

The government is budgeting to increase tax revenue to LKR 1.98 trillion (LKR 1,980 billion) in 2022, up from from LKR 1.32 trillion in 2021. Government income from total revenue and grants is expected to reach LKR 2.28 trillion, up from LKR 1.56 trillion in 2021, an increase of 46%. The following are the proposals to increase revenue streams:

• Direct Taxes

One-of surcharge Tax: Proposal to impose a one-time surcharge of 25% on individuals and corporates with an annual taxable income which exceeds LKR 2 billion for the year of assessment 2020 / 2021. However, the base at which the surcharge is to be imposed is not mentioned.

Social Security Contribution: Imposition of a 2.5% contribution based on an annual turnover exceeding LKR 120 million.

Tax concessions: While tax concessions on investments in the establishment of international schools and hospitals is mentioned in the budget bill, details of such concessions are not mentioned.

• Indirect Taxes

Increase in VAT: Proposal to increase VAT for financial services payable by licensed commercial banks, finance companies and licensed specialized banks from 15% to 18%. The applicable period is for 12 month: from 1st January 2022 to 31st December 2022.

Introduction of GST: GST included in the 2021 budget, but not implemented, is to be implement from 1st January 2022. However, a special GST to amalgamate all the excise duty on telecommunication, cigarettes, liquor, betting and gaming, is to be introduced with immediate effect.

Industry Highlights

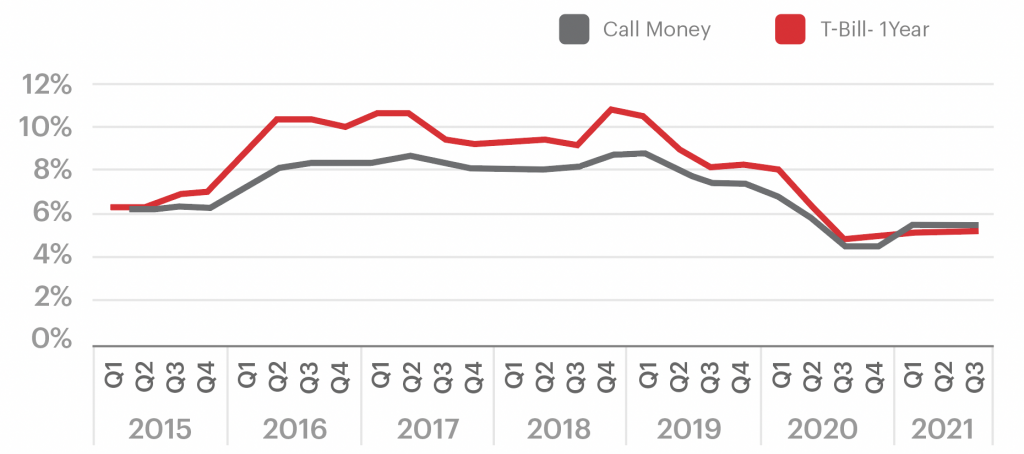

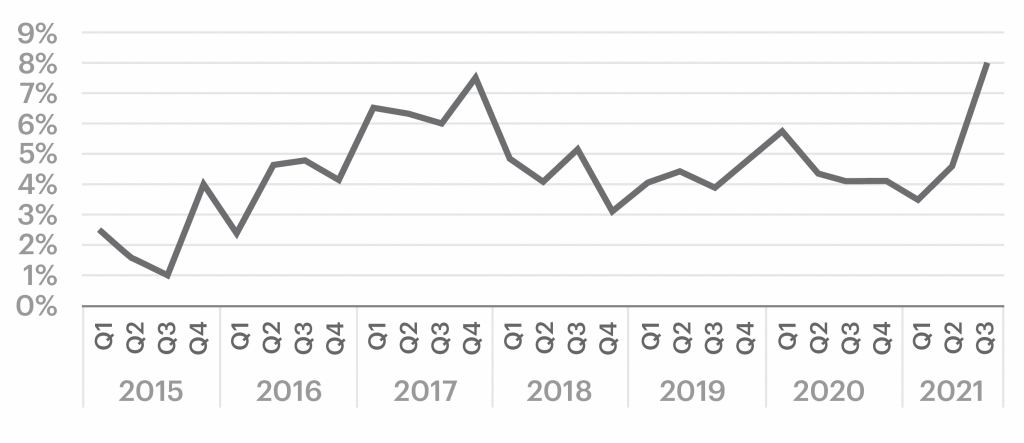

The budget does not provide an action plan to combat rising inflation, nor does it give any direction on the interest rate policy. Therefore, we are of the view that that interest rates would be kept at or slightly higher than present levels during in the medium term. The rising inflation rate and low interest rates would make real estate the perfect hedge against negative economic outcomes such as the depletion in foreign reserves, high inflation and fluctuating PMI indexes and capital markets. The real estate hedge is strengthened by the fact that there is no change in the capital gains tax on property. As per the table alongside, the proposed tax changes would almost certainly result in increased pressure on earnings, and consequently reduced dividends. This too would contribute to create a higher demand for real estate as an asset class.

Impact of tax increases

Construction

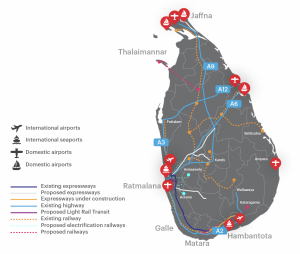

The government has allocated LKR 280 billion for the national road development program. In addition, LKR 2 billion and LKR 5 billion has been allocated for urban and rural housing projects respectively. Ongoing projects such as the following are expected to be completed between 2022 to 2024: Colombo port access elevated expressway, the New Kelani bridge, the Athurugiriya elevated expressway, the Kurunegala to Dambulla expressway, the Athurugiriya elevated expressway, the Ruwanpura expressway, the Colombo-Moratuwa marine drive extension and the flyovers in the city of Colombo.

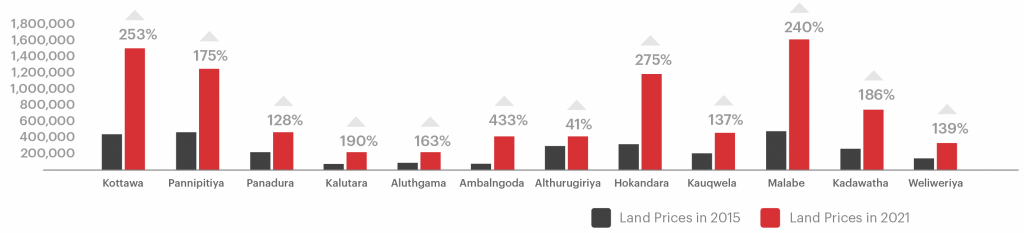

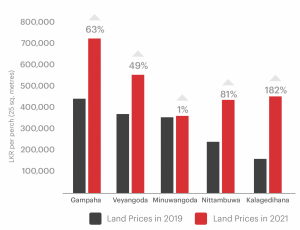

With the construction of expressways and the resultant improvements in inter-connectivity between cities, Sri Lanka has experienced significant increases in land prices in the connected cities and access points to these highways. Land prices in areas closer to the access points in the Southern expressway have increased by 20% annually from 2012 to 2015, and this growth is continuing from 2015 to today (2021). Apart from an overall CAGR of 20% in land prices, some areas such as Kottawa, Hokandara and Malabe have seen even higher price increases. The same trend is likely to continue when the national road development program nears completion.

Movement in land prices (Rs. per perch) from 2015 to 2021

Increase of Land Prices were witnessed in cities nearby Central Expressway during 2019-21

The economic activity that is planned for the outskirts of Colombo District is phenomenal.

Tourism

The budget facilitates and encourages promoting Sri Lanka as a center for wellness tourism. This initiative should result in the growth of numerous tourism developments such as event tourism, destination tourism and homestays to name a few, and thereby cascade across to provide the benefits of the tourism industry to the general public.

Agriculture

The budget has allocated LKR 39 billion for the application of non toxic weedicides and organic

fertilizer, and another LKR 22 billion for the introduction of new agro technologies.

Power and Energy

The budget has allocated LKR 500 million for the facilitation of private investment in renewable

energy. Focus on renewable energy is a key component in the government’s target to fulfill 70 percent of Sri Lanka’s energy demand through renewable sources by 2030.

With the implementation of the above mentioned proposed initiatives by the government, it is expected that the demand, and therefore prices for land would surge. Land in rural and unpopulated areas would also be in demand for the setting up of renewable energy plants. Also, beachside property values should rise as tourism picks up.

Annexure: Key economic indicators

Inflation

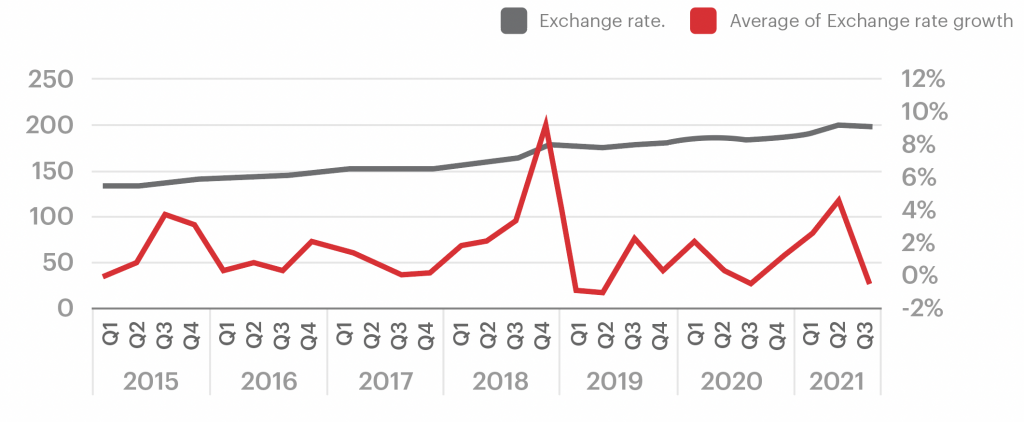

Exchange Rate (LKR per USD)

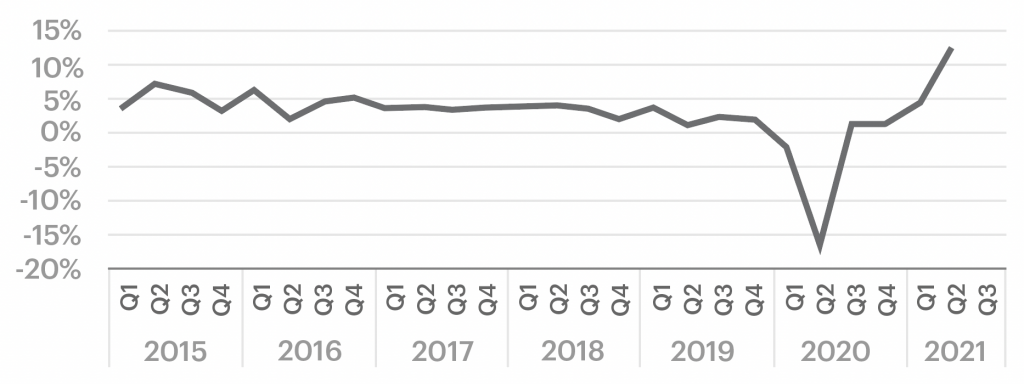

Real GDP growth

Inflation