Colombo Condominium Market Outlook

Condominium

Monetary tightening to limit economic activity during CY22.

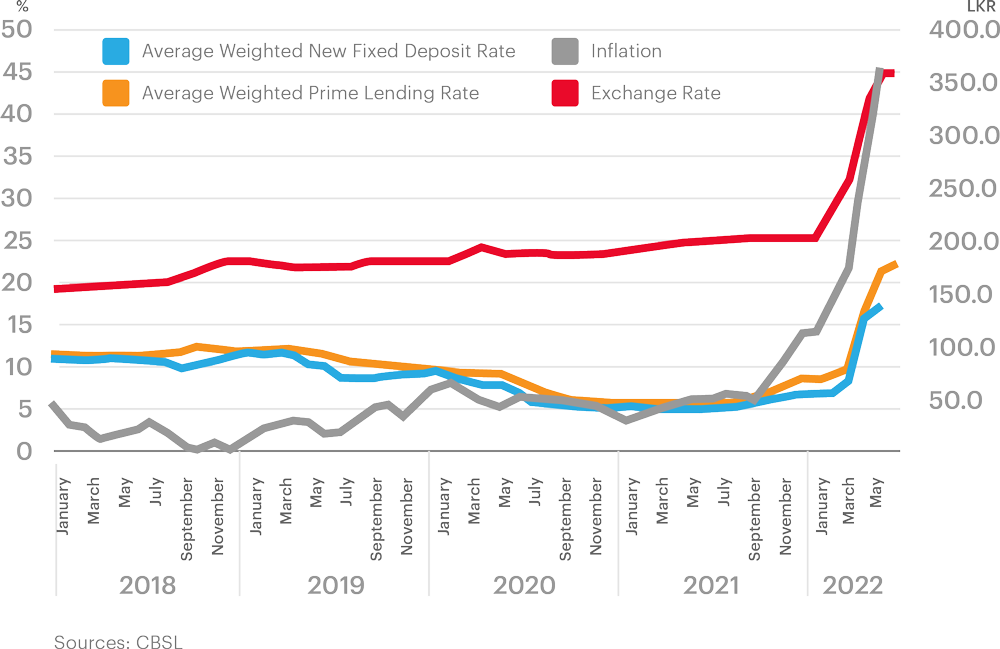

Movement of exchange rate & inflation rate alongside market interest rates

The Central Bank of Sri Lanka (CBSL) has decided to fully float the LKR since the 7th of March 2022, as a measure to tackle the depleting foreign currency reserves of the country. Since then, the LKR has depreciated by 44.20% to date. To bring the support needed to the currency, CBSL increased policy rates on 8th April 2022 by 700 basis points. CBSL also reduced the surrender requirement of Licensed Banks to facilitate the

currency float.

We expect LKR depreciation to slow down over the short term, allowing the currency to reach its lowest value and recover afterwards.

Post the policy rate hike, the 364 day T-bill rate increased to 23.36% and continued to increase thereafter ( 364 day T-bill rate at the 15th July auction was 29.87%). Bank lending rates have almost doubled while most Licensed Banks are offering fixed deposits at approximately 14.00%.

NCPI based inflation stood at 45.30% by end of May 2022 (CCPI based inflation was 54.60% YoY in June 2022). The increase in global fuel prices and other essential imports over 1H CY22 are yet to be reflected in Sri Lankan consumer prices. It may take another 3-4 months for these to be reflected in consumer prices. As such, inflation is expected to increase further. Monetary tightening in the US and Europe will also put pressure on weaker currencies that will in turn increase import costs – leading to further inflationary pressure. However, the increase in interest rates will support in absorbing excess liquidity from the market that will curtail consumption. We will be able to witness the continuation of double-digit inflation in the short to medium term.

Escalation of construction costs will limit upcoming condominium development resulting in greater demand for complete or nearly complete apartments.

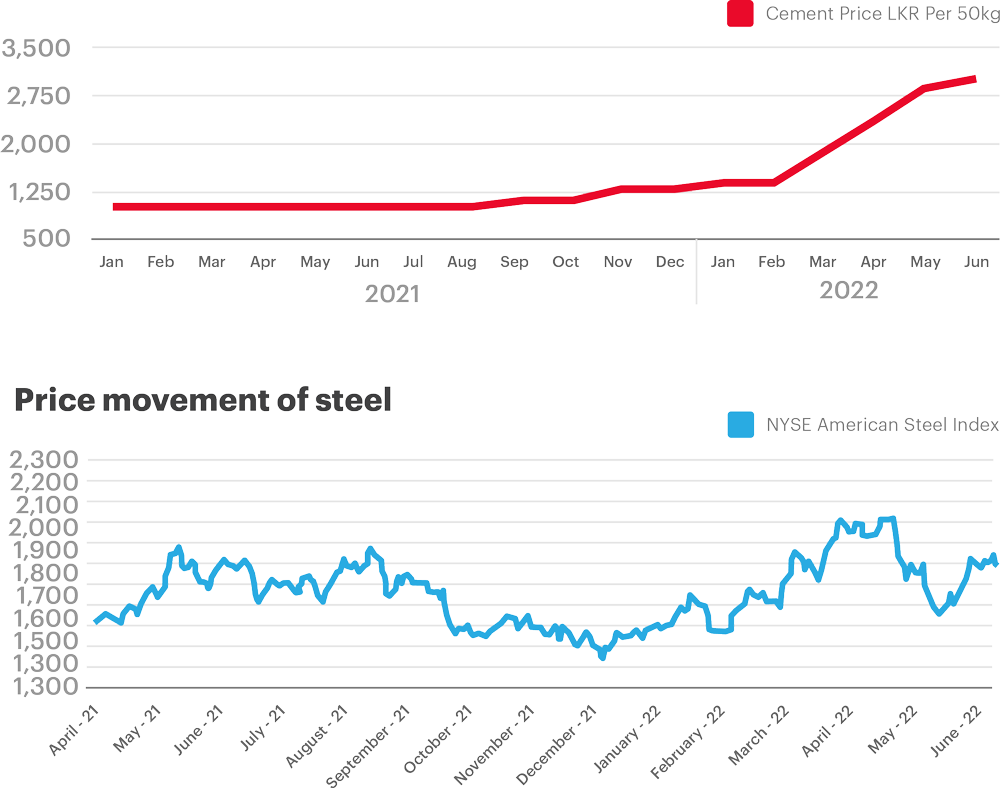

Cement price movement in Sri Lanka

Sri Lanka has witnessed a sharp increase in construction material cost in 2021 and 2022. This was amplified by the import restrictions due to USD shortages and the depreciation of the LKR against the USD.

Furthermore, labour costs had also kept increasing during the same period. However, industry experts are of the view that labour costs would stabilise in the mid term.

Global steel prices have witnessed a gradual upward trend in 2022 which will further impact the building material prices in Sri Lanka

High construction costs are expected to curtail any new launches and delay condominiums that are in the construction stage, creating a shortage of supply in the medium term (7-8 years). Therefore, condominiums that are complete or nearly complete will see significantly higher demand.

Increase in cost of construction due to scarcity of building material will result in fewer houses being constructed and this will further increase the demand for complete and nearly complete condominiums.

Prohibitive prices of land in prime locations to drive demand for apartments, while dollarisation provides a hedge for currency risk.

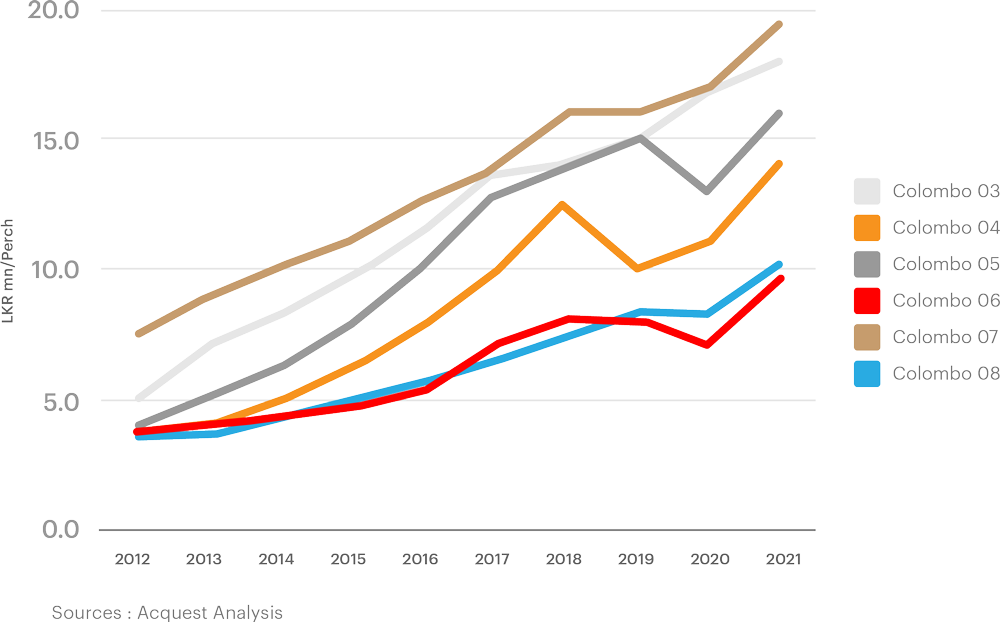

Land prices in residential areas of Colombo

Land prices in Colombo have been increasing steadily and the asking prices have gone up significantly since the LKR depreciated. Land in prime residential neighbourhoods are scarce and prices are prohibitive. A townhouse in central Colombo on a land extent of 10 perches would cost over LKR 320 mn. This makes apartments the more affordable and practical option, given the current challenges with new construction.

Dollarisation of pricing: Over the past few months, major apartment projects which are complete or almost complete (existing inventory) are already repriced in USD. This would create a hedge against LKR depreciation and hence the demand for these apartments would rise as investors look to these properties to diversify their LKR risk.

The LKR is at a very low value at present, which provides attractive apartment prices for foreign investors: LKR is at its lowest levels presently, with the currency stabilising. Hence apartment prices are currently attractive for foreign investors and for Sri Lankan expatriates who are looking to invest.

USD denominated rentals will provide a hedge for future returns.

Rental Capacity: With the availability of USD denominated rentals, investors are able to hedge the currency risk associated with LKR. Currently, 3 bedroom apartment prices range from USD 152,000 to USD 1,105,000 and rental rates range from USD 750 to USD 3,500.

Increased Safety : Many apartment complexes have gated communities, controlled access, security cameras and extra fire protection.

Considering the current macro-economic environment, Acquest recommends investing in apartments due to:

- High replacement cost given the high construction cost and the difficulty in replacing these assets in the near future.

- Limited supply of newly completed condominium developments over the next 7-8 years. Projects which are under construction have on average sold 80% of their inventory.

- Prohibitive land cost, scarcity of land in residential areas and the challenges of new construction will further drive demand for apartments.

- Dollarisation of apartment prices providing a hedge against LKR currency risk.

- Dollarisation of rentals to provide a hedge for future rental returns against the LKR currency risk.